Stryde is leading a new era for sports.

Stryde is leading a new era for sports.

Stryde is leading a new era for sports.

We are opening the door to an asset class that has always been reserved for

celebrities and billionaires.

We are opening the door to an asset class that has always been reserved for

celebrities and billionaires.

Deep experience across finance, tech and sports

We’re building the platform for investors who dare to shape the future

We’re building the platform for investors who dare to shape the future

We’re building the platform for investors who dare to shape the future

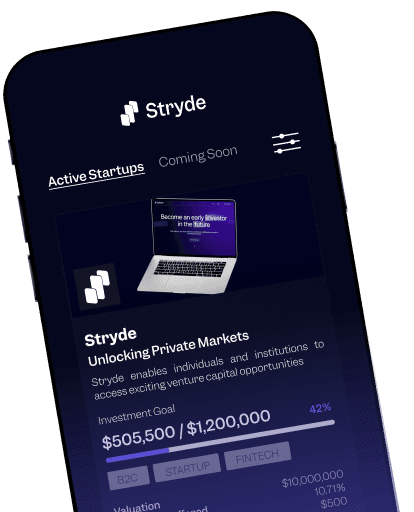

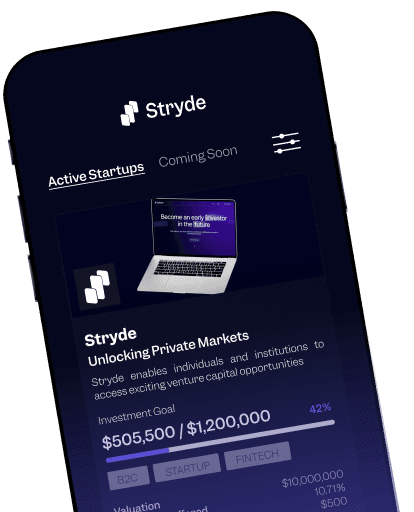

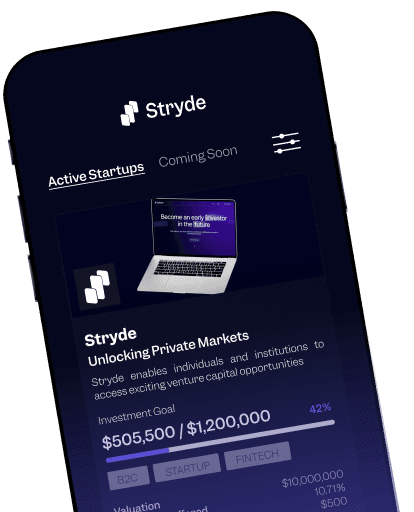

Investing used to be exciting. But over time, that excitement has been overshadowed by complicated processes, inaccessible deals, and barriers that keep most people out regardless of their wealth. Frustrated with the lack of opportunity for investors, we set out to change the way private markets work. We called it Stryde, to signify crossing the barriers to exciting opportunities.

What started as a vision to democratise sports investing has now evolved into a fully regulated investment platform that opens up access to private equity for individuals and institutions alike. Stryde isn’t just about giving passionate investors a way to invest, it’s about giving them a way to thrive in markets that were once out of reach.

Investing used to be exciting. But over time, that excitement has been overshadowed by complicated processes, inaccessible deals, and barriers that keep most people out regardless of their wealth. Frustrated with the lack of opportunity for investors, we set out to change the way private markets work. We called it Stryde, to signify crossing the barriers to exciting opportunities.

What started as a vision to democratise sports investing has now evolved into a fully regulated investment platform that opens up access to private equity for individuals and institutions alike. Stryde isn’t just about giving passionate investors a way to invest, it’s about giving them a way to thrive in markets that were once out of reach.

Investing used to be exciting. But over time, that excitement has been overshadowed by complicated processes, inaccessible deals, and barriers that keep most people out regardless of their wealth. Frustrated with the lack of opportunity for investors, we set out to change the way private markets work. We called it Stryde, to signify crossing the barriers to exciting opportunities.

What started as a vision to democratise sports investing has now evolved into a fully regulated investment platform that opens up access to private equity for individuals and institutions alike. Stryde isn’t just about giving passionate investors a way to invest, it’s about giving them a way to thrive in markets that were once out of reach.

Stryde co-founders Emad Yehya and Hadi Halabi.

Stryde co-founders Emad Yehya and Hadi Halabi.

Meet the team

Meet the team

Backed and advised by the best

Backed and advised by the best

Access investments previously reserved for the top 0.1%

Stryde enables investors to gain exclusive access to fully vetted sports investment opportunities. We’ve made sports private equity seamless. From onboarding and investing to reporting and exiting, every step of your investment journey is fully digitised and right at your fingertips.

We co-invest alongside elite financial institutions and athletes while offering premium perks such as access to games and invites to sporting events, giving you a true seat at the table in the most exciting asset class.

Sports is now a serious asset class

At their core, sports are growth assets with compelling financial and operating performance, proven by major sports leagues continuously outperforming the S&P 500 over the last decade.

We believe sports ownership offers a unique combination of secular tailwinds and low correlation with traditional asset classes while providing venture capital returns with private equity risk levels.

Annualised returns over the past decade

Annualised returns over the past decade

Stryde is regulated by DFSA

Stryde is regulated by DFSA

Regulated in UAE by the DFSA

We’re licensed and regulated by the Dubai Financial Services Authority (DFSA)

Share certificates in the SPV

Investors receive verifiable ownership documents issued by Dubai International Financial Center (DIFC)

Become a sports investor today

Join a community of savvy investors and gain

access to the most exciting asset class

Become a sports investor today

Join a community of savvy investors and gain access to the most exciting asset class

Become a sports investor today

Join a community of savvy investors and gain access to the most exciting asset class