The playbook for sports ownership has fundamentally changed.

Today, it’s not just about scoring goals or lifting trophies; it’s about building multi-dimensional businesses that span far beyond the field. The top 20 ownership groups in global sport are now worth over $225 billion, placing them on par with mid-sized national economies.

What’s driving that level of enterprise value? Not just winning. It’s about owning the full stack; from stadiums to screen time, from fan data to broadcast deals.

The New Model: Own the Infrastructure, Not Just the Team

The most forward-thinking sports groups are designing integrated ecosystems. Their assets include everything from digital media rights and event production studios to hospitality, retail, and real estate.

Take the case of conglomerates like Kroenke Sports & Entertainment, who manage a portfolio of elite franchises such as Arsenal, the LA Rams and four other major teams. Their real strength isn’t just in the roster; it’s in controlling the full commercial footprint: stadiums, media outlets, merchandising, and more.

Likewise, operators like the Jones family have turned teams like the Dallas Cowboys into global business hubs, where the brand is both a sports product and a commercial engine.

Going Global: The Rise of the Multi-Club Network

Owning one club is no longer the end goal. Increasingly, groups are spreading investments across continents, forming multi-club networks that reduce risk and multiply commercial potential.

Organizations like City Football Group have pioneered this model, with a presence in over a dozen clubs across six continents, leveraging shared data, training models, and talent pipelines. This isn't diversification for the sake of it; it's a strategy built around global fan acquisition and operational efficiency.

Similarly, entities like 49ers Enterprises are applying lessons from U.S. sports to European markets, unlocking growth by extending proven systems into new geographies.

Value Lives Behind the Scenes

What separates modern sports empires from traditional clubs is the ability to monetize the off-pitch layers of the business.

These include:

In-house content production and control over media rights

Digital platforms that gather and activate fan data

Strategic player movement across owned clubs to maximize both performance and asset value

The infrastructure around the team has become the real driver of margin and scale.

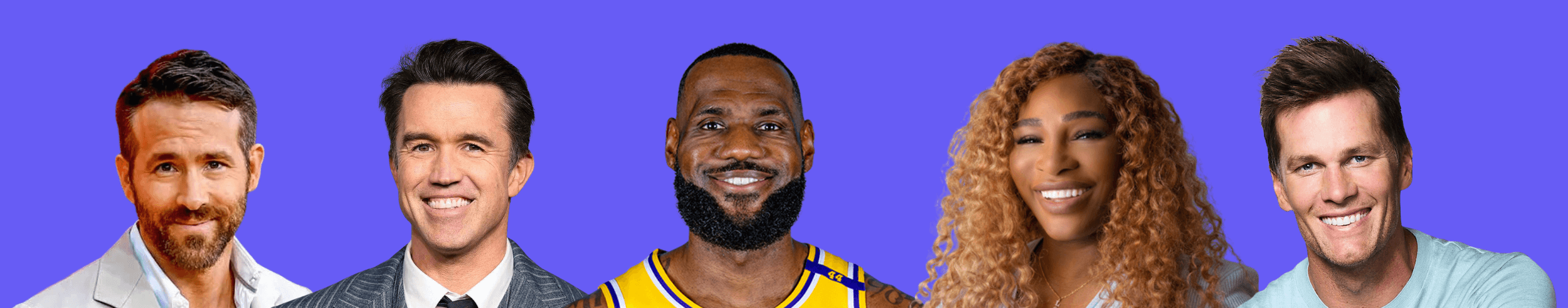

The Celebrity Investor Era

It’s not just billionaires or institutional investors getting involved anymore, athletes and entertainers are becoming key players in reshaping ownership models.

Ryan Reynolds and Rob McElhenney turned Wrexham into a globally followed media brand.

LeBron James holds equity in a major sports holding group with teams across baseball, basketball, and football.

Serena Williams, Tom Brady, and others are helping accelerate the growth of U.S. and women’s sports by investing early and building long-term influence.

What these individuals bring is more than capital, it’s reach, relevance, and media power.

What’s Next?

The future of sports ownership is already taking shape:

Greater private equity participation in strategic assets

Commercial-scale growth in women’s leagues and fan platforms

Integrated media experiences that combine live events, content, and global distribution

This is no longer about owning a team. It’s about building a platform.

At Stryde, we’re working with investors, operators, and innovators who see sport not just as a product, but as a powerful, scalable business category. From infrastructure and IP to monetization and fan engagement, this next era belongs to those who build boldly.

The empire era is here. Are you in?