A New Run for the Sport – 2025 and Beyond

Horse racing isn’t a thing of the past; it’s making a powerful comeback. Once seen as a tradition losing ground, the sport is now charging into 2025 with fresh energy, investment, and global attention. Modern tracks are transforming into high-tech entertainment arenas. Owners and syndicates are reshaping old models of control into agile, data-driven enterprises. What used to be a gentleman’s pastime is turning into a precision business, and the world is watching.

The industry is on an undeniable upswing. The global horse racing market is projected to grow at a CAGR of 7%, reaching over $182 billion by 2030, up from $127 billion in 2025. That’s not nostalgia; that’s momentum.

The Growth Flywheel

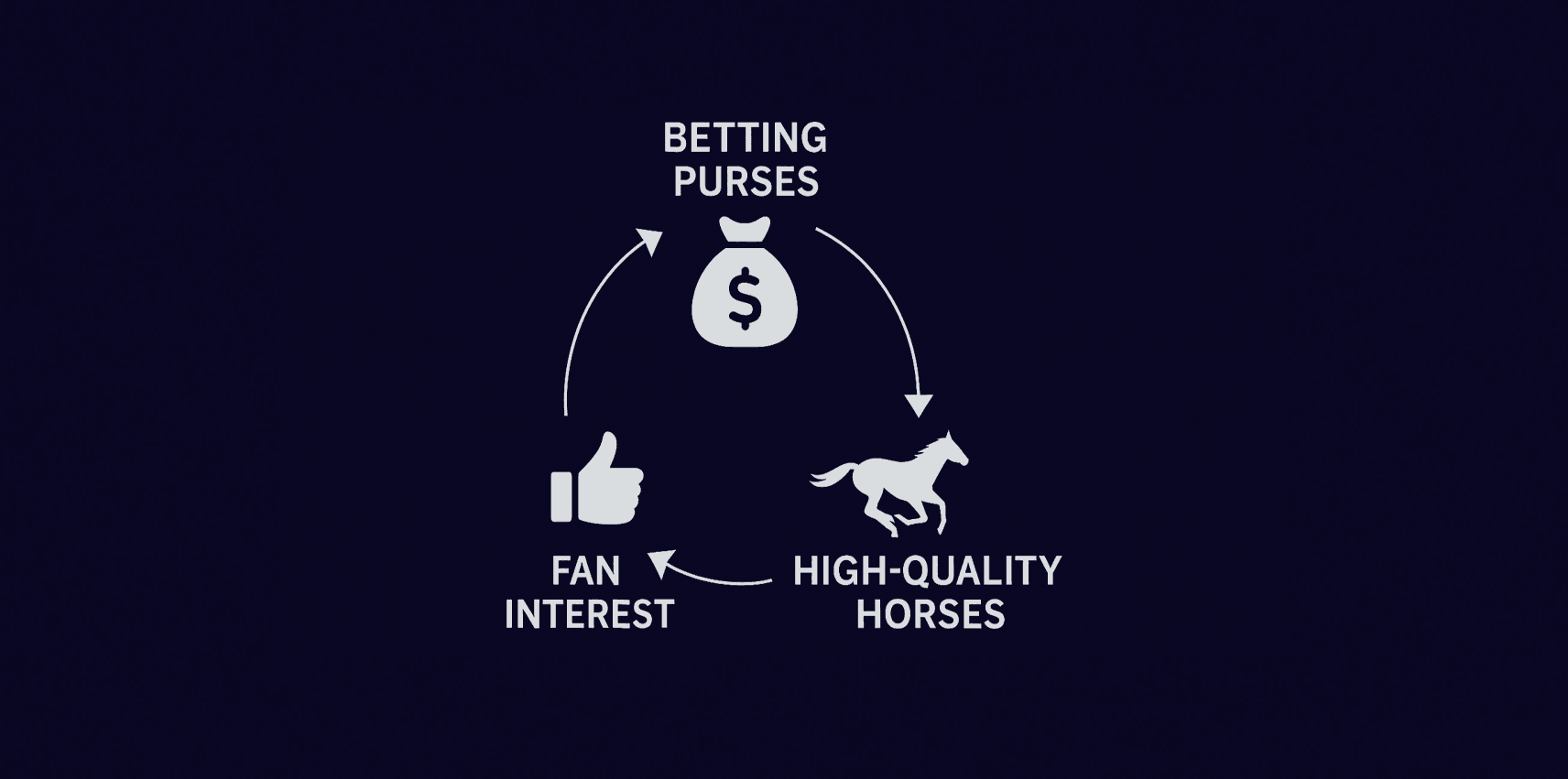

What’s fueling this resurgence is a mix of renewed investment, modernised venues, and the steady growth of regulated wagering. Together, they’ve created a wave of reinvestment that the sport hasn’t seen in decades.

As betting activity expands responsibly across digital platforms, it’s generating the funds that drive larger purses, and when the purse grows, it attracts higher-quality horses, which in turn draw greater fan interest and fresh capital back into the sport.

Racecourses are being reimagined to meet rising demand. Churchill Downs is investing $300 million in a new paddock and grandstand, Belmont Park is undergoing a $500 million state-backed renovation, and Maryland has approved $400 million to overhaul Pimlico. These investments are set to revive and expand the sport in 2025 and beyond.

And the investors aren’t just spectators. Danny Moses, the trader made famous in The Big Short, is one of 14 elite investors in Starlight Racing, which owns 26 horses. Their stable has finished “in the money” more than half the time, earning over $64 million in purse money. That model is spreading fast. In some top races, owners now pay nearly $1 million for a slot, an entry they can use, sell, or lease, turning participation itself into an asset.

From Tradition to Transformation

Beneath the spectacle, the foundation of horse racing is being rebuilt for longevity. The creation of the Horse Racing Integrity and Safety Authority (HISA), established by the Federal Trade Commission, is bringing long-overdue oversight to a sport once known for fragmented rules and inconsistent welfare standards. That transparency is exactly what investors have been waiting for.

Institutional players are taking notice. Private equity firms, hedge funds, and family offices are entering the paddock with structured portfolios and long-term strategies. What was once a fragmented pastime is evolving into a regulated, trusted, and globally investable sport.

Major Races, Modern Fans – Momentum in Motion

Across the world, major races are evolving from classic spectacles to immersive, high-energy experiences. The 2025 Triple Crown, featuring the Kentucky Derby, Preakness Stakes, and Belmont Stakes, reignited global excitement for the sport. A staggering 17.7 million viewers tuned in to watch this year’s Kentucky Derby, the largest television audience for the opening leg of the Triple Crown since 1989.

Following the U.S. season, the momentum goes worldwide. The upcoming Melbourne Cup in Australia, the Japan Cup in Tokyo, and the Hong Kong International Races at Sha Tin are all set to capture global attention through late 2025. These events bring together the world’s best horses, trainers, and investors, keeping the season’s energy alive year-round and drawing new fans into the sport’s orbit.

What’s powering this surge isn’t just the races; it’s the conversation around them.

Social media has become racing’s modern grandstand, turning highlights, rivalries, and replays into shareable moments that reach millions. Platforms like TikTok and X (Twitter) are helping fans connect, learn, and build communities that extend far beyond the track.

Why Stryde is Watching this Closely

At Stryde, we’re following this resurgence closely. The revival of horse racing is more than a sporting story; it’s a blueprint for how legacy industries can reinvent themselves through innovation, regulation, and renewed public trust.

The sport is attracting new capital, new audiences, and a new sense of purpose. With stronger governance, global events, and investment-grade participation, horse racing is building a future that’s faster, fairer, and more connected than ever before. Because in every race, whether on the track or in the market, momentum belongs to those who see the next turn first. The gates are open, and the future is at full gallop.